- Trust Fund Insider

- Posts

- Billionaires are Selling Palantir To Buy This Stock

Billionaires are Selling Palantir To Buy This Stock

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs behind Uber and eBay also backed Pacaso. They made $110M+ in gross profit to date. They even reserved the Nasdaq ticker PCSO. Now, you can join, too.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

The Billionaire's Secret Move That Wall Street Doesn't Want You to See

Why Stanley Druckenmiller just made the most contrarian bet of his career

Stop.

Before you buy another share of anything, you need to see this.

Stanley Druckenmiller - the guy who never had a losing year from 1981 to 2010 - just did something that should terrify every AI investor.

He sold his entire Palantir position.

All of it.

And he's buying something that most people think is dead money.

The Move That Changed Everything

Here's what happened in the shadows of Wall Street while everyone was chasing AI stocks:

Druckenmiller quietly dumped every single share of Palantir. The same stock that's up over 700% in two years. The darling of the AI revolution.

Then he did something even stranger.

He started buying Teva Pharmaceuticals. A boring drug company that nobody talks about at cocktail parties.

This isn't just any investor. This is the man who made George Soros $1 billion in a single day. The legend who spotted every major bubble before it popped.

And he's screaming "DANGER" at the top of his lungs.

The Numbers That Made Him Run

Want to know what scared him off?

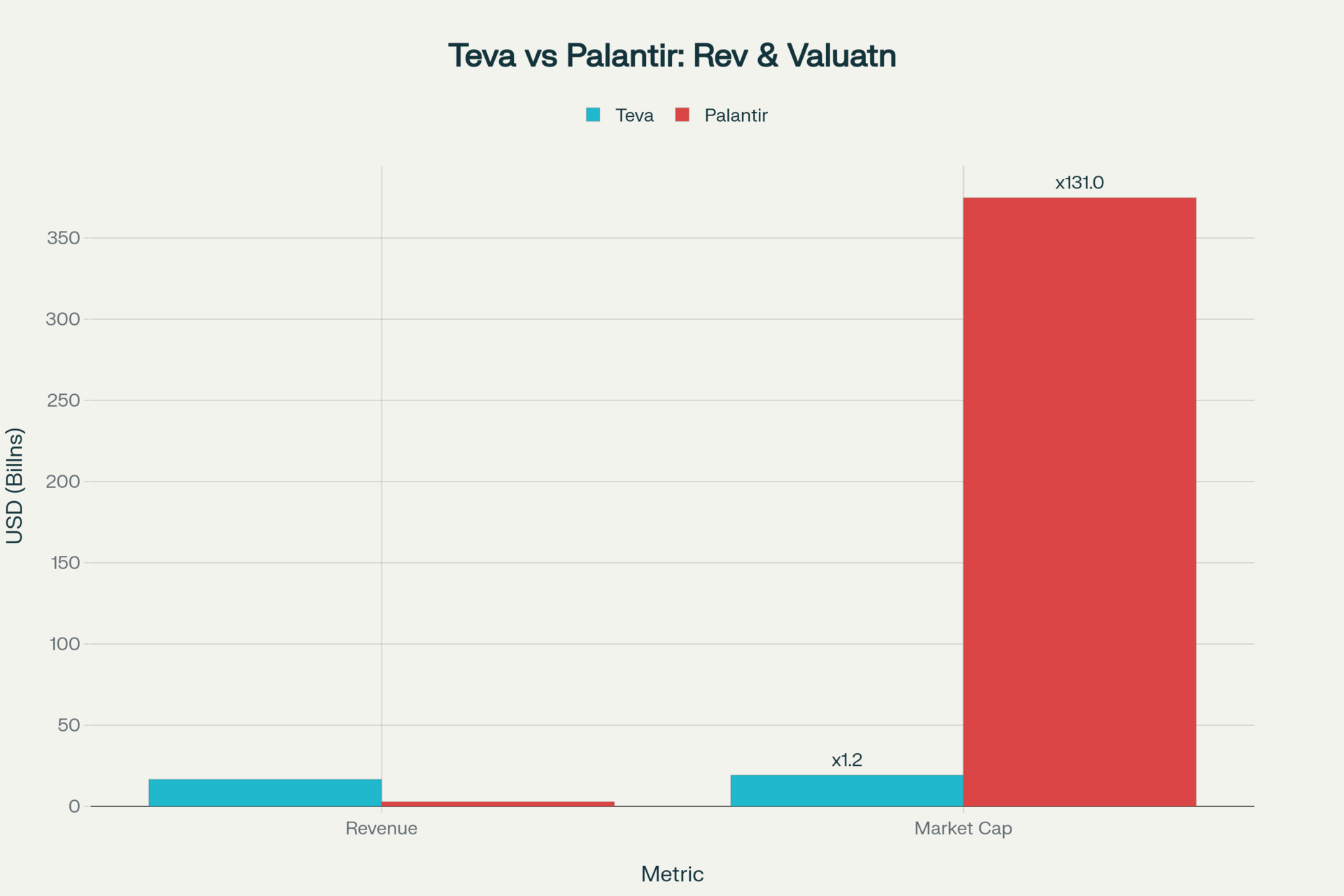

Palantir trades at 119 times sales.

Let that sink in.

During the dot-com bubble - the worst tech crash in history - the most overvalued companies peaked at 43 times sales.

Palantir is trading at nearly THREE TIMES that level.

Even if they converted every dollar of revenue into pure profit (impossible), it would take until 2080 for investors to break even at today's prices.

Your great-grandchildren would be collecting dividends before you saw your money back.

The Pattern Every Bubble Follows

Here's what Wall Street doesn't want you to know:

Every bubble looks the same before it pops.

Everyone thinks "this time is different"

Valuations reach historic extremes

Smart money starts running for the exits

The media keeps pumping out bullish stories

Sound familiar?

Druckenmiller has seen this movie before. In 2000 with tech stocks. In 2007 with housing. In 2021 with meme stocks.

He knows how it ends.

The Teva Play Nobody Understands

While everyone's losing their minds over AI, Druckenmiller found something better:

A company trading at 5.8 times earnings instead of 500. A business generating $16 billion in revenue instead of promises. A stock that could double without anyone noticing.

Teva has posted 10 straight quarters of growth. They're cutting costs by $700 million. They've slashed debt from $35 billion to under $15 billion.

And here's the kicker: Goldman Sachs thinks it's going to $24. That's 44% upside from here.

The Insider Secret

You want to know the real reason billionaires are running from AI stocks?

They're not buying the story anymore.

Philippe Laffont cut his Nvidia position by 80%. Israel Englander dumped 90% of his Palantir stake. Jeff Yass trimmed Palantir by 28%.

These aren't random moves. This is coordinated retreat.

The smart money is telling you something. The question is: are you listening?

What History Teaches Us

Every mega-bubble follows the same script:

Phase 1: New technology emerges (AI, internet, housing) Phase 2: Valuations go parabolic Phase 3: Smart money exits quietly Phase 4: Retail investors keep buying Phase 5: Everything crashes

We're somewhere between Phase 3 and Phase 4 right now.

The billionaires are in Phase 3. Most retail investors are still in Phase 2.

Guess who wins?

The Teva Advantage

While Palantir relies on government contracts and hype, Teva makes things people actually need:

Generic drugs that save lives

ADHD medications during a shortage

Multiple sclerosis treatments

Essential medicines that don't go out of style

When the AI bubble pops, people will still need medicine.

They won't need $374 billion data analytics companies.

The Risk Nobody's Talking About

Here's what keeps me up at night about Palantir:

If the stock drops 50%, it's still overvalued. If it drops 75%, it's still expensive. If it drops 90%, it might be fairly priced.

That's not investing. That's gambling.

Teva, on the other hand, trades near book value. The downside is limited. The upside is real.

The Druckenmiller Playbook

This is how legends think:

Buy low, sell high (not the other way around)

Follow value, not momentum

Exit before the crowd realizes the party's over

Find quality companies at discount prices

It's not sexy. It doesn't make for good Twitter posts. But it works.

What This Means for You

You have a choice right now:

Follow the crowd into overvalued AI stocks and hope the music doesn't stop.

Or follow the billionaires into boring, profitable companies trading at reasonable prices.

One of these strategies has created more wealth than any other in history.

The other has destroyed more fortunes than war.

The Bottom Line

Druckenmiller didn't get rich by following trends.

He got rich by spotting them early and exiting before everyone else.

Right now, he's telling you the AI party is over.

The question is: will you listen?

Or will you be holding the bag when the music stops?

The smart money has already decided.

What about you?

This isn't investment advice. But if one of history's greatest investors is running from the hottest stock on the planet, maybe you should pay attention.

Important Disclaimer

This is not investment advice. Nothing in this article should be considered a recommendation to buy, sell, or hold any security. The author is not a licensed financial advisor, broker, or investment professional.

Past performance doesn't guarantee future results. Stanley Druckenmiller's historical success doesn't mean his current moves will be profitable. All investments carry risk of loss.

Do your own research. The information presented here is based on publicly available data and the author's interpretation. Market conditions change rapidly. Stock prices can go up or down regardless of fundamentals.

Potential conflicts of interest. The author may have positions in mentioned securities. This article is for educational and entertainment purposes only.

Consult a professional. Before making any investment decisions, speak with a qualified financial advisor who understands your specific situation, risk tolerance, and investment goals.

Market risk warning. All stocks mentioned can lose value. You could lose some or all of your investment. Never invest money you can't afford to lose.

No guarantees. Nothing in this article guarantees any outcome. The stock market is unpredictable and influenced by countless factors beyond any single investor's control.

Invest responsibly. Your financial future is too important to risk on speculation.